Why We Decided to Raise Venture Capital

Why did I, a natural born indiehacker bootstrapper, become an apostate by deciding to do the very thing bootstrappers rally against?

Good question.

I grew up in the business world around indiehackers and bootstrappers, reading books like Getting Real, listening to podcasts like Startups for the Rest of Us and going to conferences like Microconf. I learned all the benefits of bootstrapping and all the problems of raising venture capital.

But I also learned the limitations of bootstrapping.

As every software engineer eventually learns, everything has tradeoffs. The majority of options are not objectively better or worse in every situation. The best option in a situation is often highly situation dependent.

Anyone sufficiently seasoned cannot, with a straight face, declare that either bootstrapping or raising capital is always better than the other.

When starting a new business, I think your default should be to bootstrap it. It is easy to get caught up in the glory that seems to befall VC funded startups. But raising a funding round in and of itself is not an indicator of success.

Raising a funding round is simply one of the many tools in the entrepreneur's tool belt.

Our default when starting Flightcontrol in 2021 was to bootstrap it. I never expected to raise investment. I didn't lay in bed at night dreaming about being on the front page of TechCrunch. Instead, I worried about how we would actually bootstrap it and how long it would take before it provided even a modest income.

Prior to starting Flightcontrol, I had already bootstrapped Blitz.js from zero to tens of thousands of users all around the world. I had invested over $200,000 of my own time into Blitz. On average, I worked 20 hours per week for consulting clients and 30 hours on Blitz. I didn't grow up rich and my highest salary job before I quit to do consulting was only paying $85k per year. And my wife at the time had chronic health issues that were expensive and prevented her from working. So I had zero cash stores to lean on.

And then, on top of that, we were setting out to build a developer-first infrastructure platform. At that point, we basically had not one but two ambitious products, Blitz.js and Flightcontrol (a year later, in 2022, we put Blitz into maintenance mode).

Hopefully now it's becoming more clear why we started considering venture capital.

On top of the financial aspect, we want to build a legacy. A decade-defining company with incredible impact. We explicitly want to build a massive business rather than a tiny one. We want to build a really awesome company that provides a ton of fulfillment for many employees and customers. We want to make radical inventions that significantly improve the lives of developers and make cloud infrastructure more accessible to more people. After carefully considering our financial and hiring needs and our business goals, raising venture capital became a clear choice.

So what is it like to raise venture capital? Did investors force us to sell our soul?

Going through the fundraising process was overwhelmingly positive for us, even if we hadn't successfully closed that first round in 2021. It has forced us to sharpen our vision and hone our business plan. Talking to investors forces you to face really important things that are easy to ignore as an independent bootstrapper, like exactly how to prevent competitive arbitrage over the long term. Our path to success is now much more clear.

There's a stigma that VC funded companies are "crazy", "not calm", etc. While there are certainly many cases that validate the stigma, in reality, it's not the VC funding that makes for a bad work environment. A bad work environment is caused by the founders and leadership, regardless of whether they have investors or not. The experience of our employees is our number one priority. We care deeply about having a stress-free, fulfilling work environment. People do their best work when they enjoy their work and are in a thriving environment.

Raising capital reduced our stress as founders. All our expenses are fully covered, so we don't have to stress about paying bills or draining our savings. It allows us to hire amazing people and pay them a great salary. Sustainability is one of our core values, and paying everyone a good wage is one aspect of that.

Additionally, raising capital enables you to attempt to short circuit the infamous "long, slow SaaS ramp of death" that plagues new SaaS companies. Investment capital may allow you to compress time and achieve escape velocity in a fraction of the normal time. But the initial growth ramp to product-market fit is still incredibly difficult. Many venture funded companies can take as long to reach product-market fit as bootstrapped companies. But at least you are getting paid during that time!

We were also fortunate to have many industry leaders join as angel investors. This has given us surprising access to world-class people who are available as advisors and promoters. People who have already "been there and done that" in high-stakes situations can help us not repeat their mistakes. I highly encourage every bootstrapped founder to consider raising an angel round for this benefit!

At the end of the day, building any software business large enough to financially support one or more people is incredibly difficult. And investment capital is one of the tools you have available on the journey. For us, it’s absolutely been the right choice.

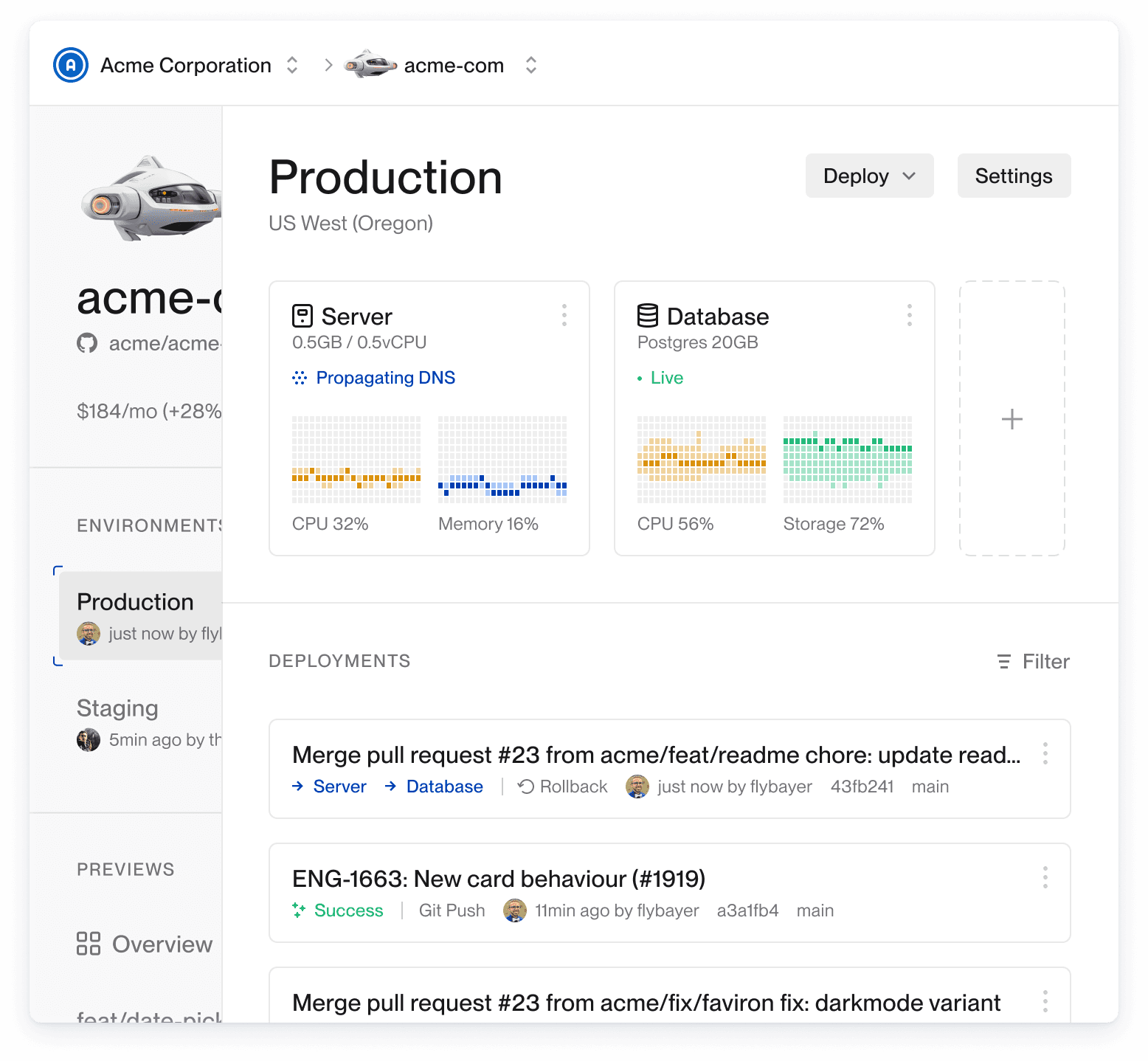

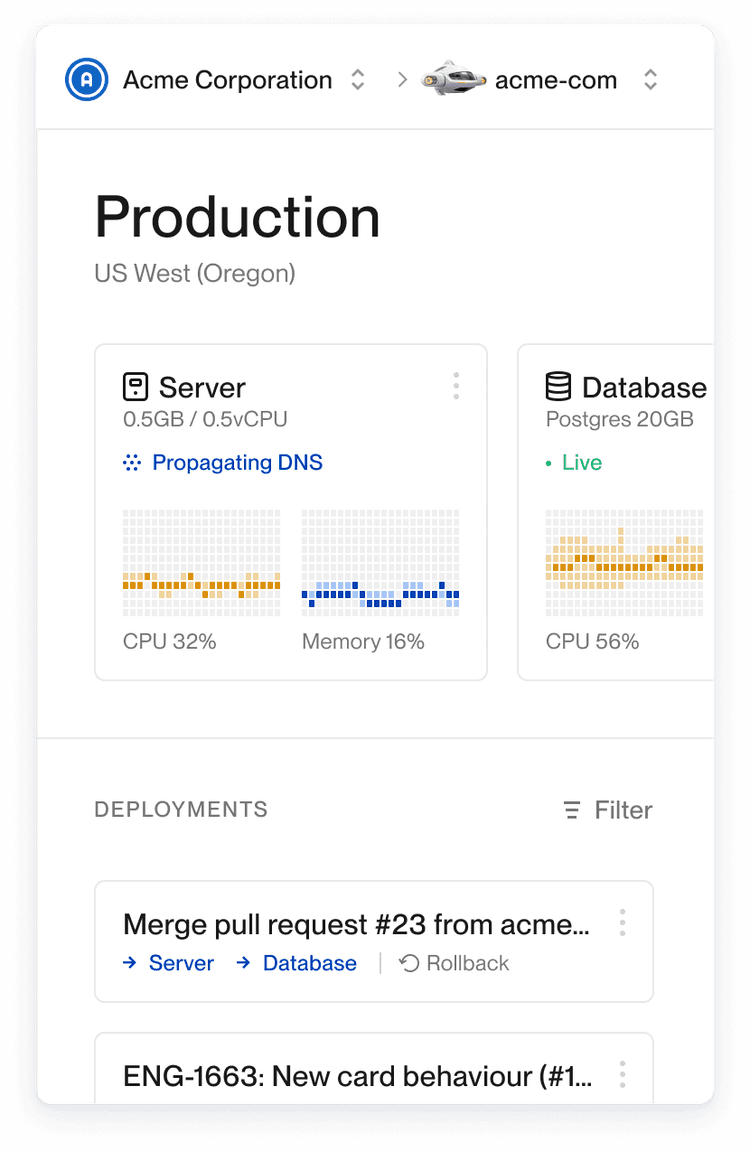

Deploy apps 2-6x faster, 50-75% cheaper & near perfect reliability